22. 12. 2023

Here in Europe most of the legal systems require to issue an invoice for every income we are paid into our bank account. Luckily, Apple knows it and it enables the invoicing via an iTunes Connect account.

iTunes Connect and invoices

Follow these steps in your iTunes Connect account:

Resources and Help -> Contact Us -> Reports and Payments -> Payments and Financial Reports -> Contact Finance -> Invoicing Apple for Apps -> Invoice Upload (Choose) -> Submit

Currently (October 2018), iTunes Connect gives you instructions to issue and send an invoice for the company Apple Distribution International based in Ireland. It is also stated, that you should issue it with 0% VAT. But, take your time and check current and exact wording by yourself.

Apple Distribution International VAT number

Your accountant probably needs it to handle all EU requirements properly. Now (October 2018), the details needed are IE9700053D and the address:

Apple Distribution International

Internet Software & Services

Hollyhill Industrial Estate

Hollyhill, Cork

Republic of Ireland

Again, better check the FAQ in iTunes Connect just to be sure it is still correct and this VAT number is still valid.

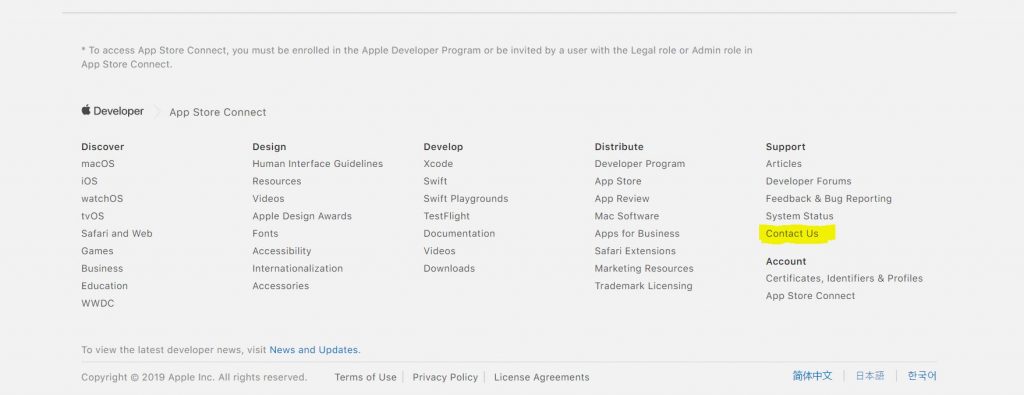

“View Contact Us” section

After clicking on Resources and Help in the main menu scroll down to the Contact Us section on the right. You could further submit the form by following these steps:

- On the bottom of the page click on Contact Us.

2. Select Reports and Payments.

3. Select Payments and Financial Reports.

4. Select Contact Finance.

5. Scroll down and select Subject – Invoicing Apple for Apps

6. In Invoice upload choose your invoice for Apple from your hard drive

7. ….and click Submit

Done!

Do you need more detailed help? Book a consultation:

Let’s chat about it

Do you want more?

We share the world of software development on our Instagram. In case you have any questions, let’s chat there! 🙂